Digital Transformation for BFSI

Future banking and Organization Imperatives

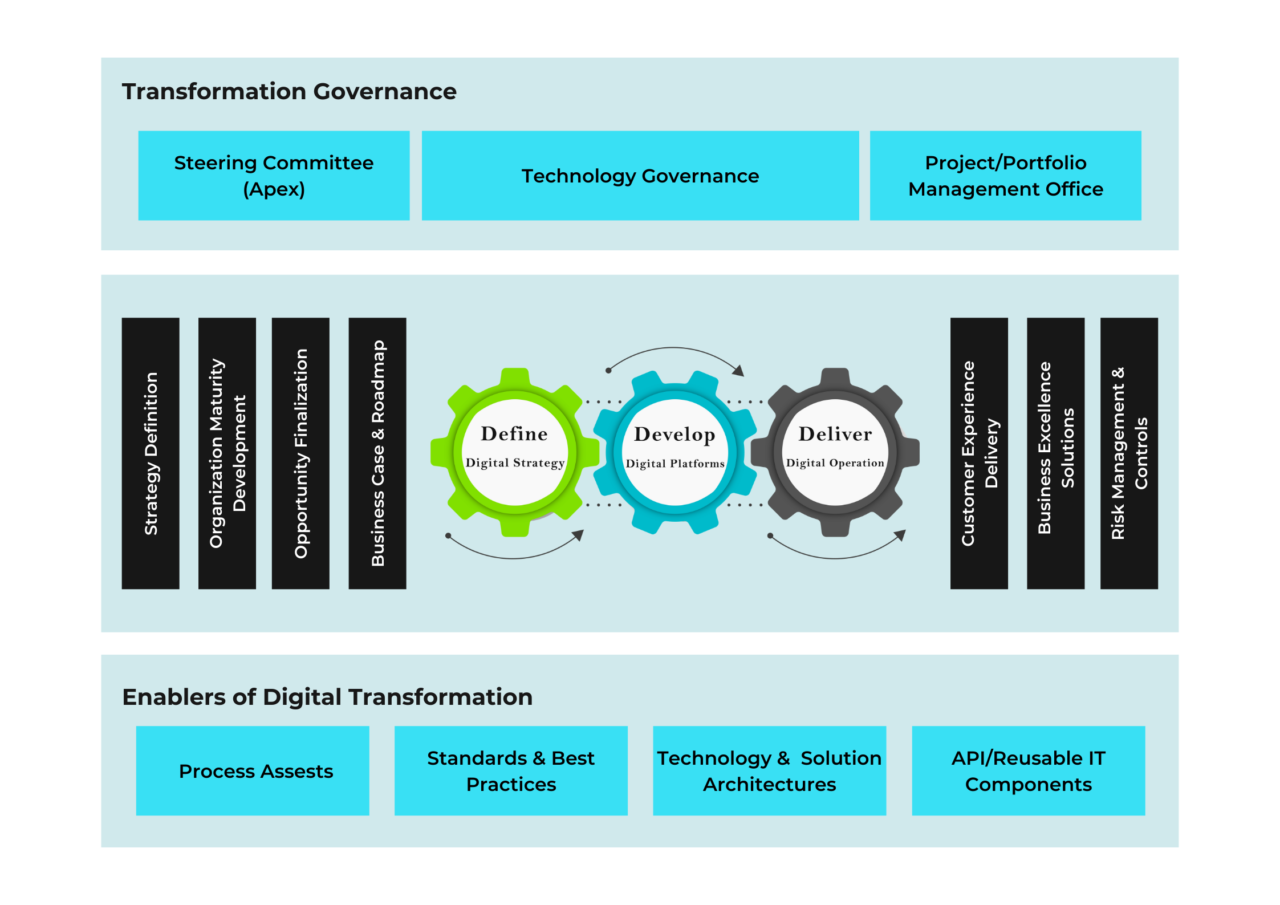

Digital transformation is a composite of a business model (strategy, business process, technology, innovation, and culture) rather than a monochrome. As a result, it’s critical that the digital transformation strategy be thorough and complete.

Our Approach

Any digital transformation program should aim to provide a superior business and end-user experience by providing a flexible, responsive, and forward-thinking service that meets current and future business demands at a low cost.

3D Approach (Define – Develop – Deliver)

Digital Transformation Journeys Examples

Contact Me

- Client Onboarding

- Creating an account

- Know-Your-Customer (KYC) Management

- Customer Account Management

- Management of BAU Operations (Customer Information Updates)

- Customer Service (Non-financial Transactions – Ex Balance Enquiry, Letters, and Issuance of Certificates). Transactions involving payments and money transfers

- Regulatory & Compliance

- Compliance and Audit

- Management of Mandatory Training and Disclosures Daily/Weekly/Monthly/Concurrent Review Management of Ongoing and Regulatory Controls

- New Business Services and Products

- Quick and customized product releases

- Personalized and new service definition

To summarise, digital transformation in banks entails much more than simply transitioning from traditional banking to a digital environment. It’s a game-changing shift in how banks and other financial institutions collaborate with multiple stakeholders to provide solutions. Understanding consumer and corporate goals and balancing them to execute changes that enable enterprises to leaps and bounds of profitability and success with unwavering customer happiness is the foundation of successful digital transformation.